Integrated Payment Processing

We don't stop at providing pos systems. We help customers find the right merchant processing company for fully integrated payment processing solutions highly secured with beyond industry standards. With this additional offerings, our clients can achieve better shopping experiences as well as overall savings from payment processing cost. POS Unlimited partners with industry leading companies such as Vantiv Integrated Payment (formerly Mercury Payment System) for credit, debit, EBT, and gift card processing solutions with EMV certified terminals.

Key Benefits of Integrated Payment Processing

• Integrated payment processing with your POS system eliminates errors from manual entries on non-integrated stand alone terminals.

• Incredible speed of transactions via high speed internet

• Electronic signature capture support for paperless operation

• Detailed transaction reports (on line report available)

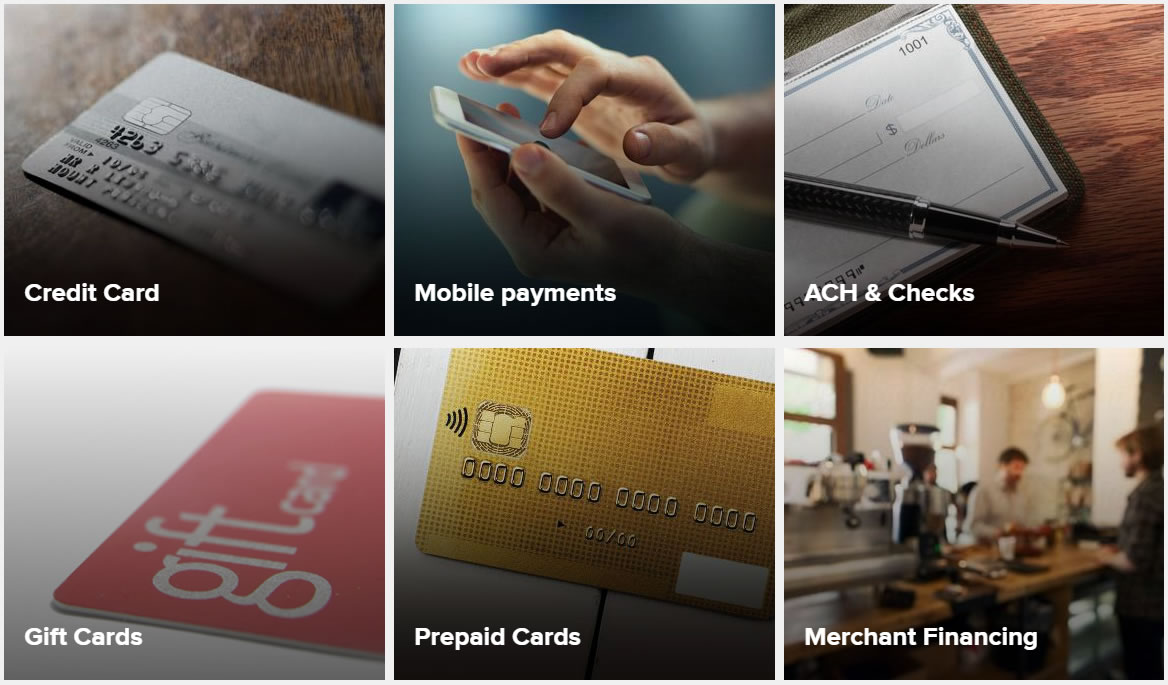

• All payment types including credit, debit, EBT, gift cards, mobile payment including ApplePay, Google Pay and Samsung Pay...etc..

Payment Processing Partners

Benefits of Integrated Payments

Credit Card, Debit Card, Gift Cards, and Purchasing Cards

Integrated payment solution provides complete processing capabilities for all major credit, debit, gift cards, and purchasing cards. Our partners process billions of transactions a year, authorize the transactions in seconds, and then direct the information to the appropriate card network for payment. POS Unlimited only works most reliable networks in the industry, you can be assured of quick connections and continuous service.

A Powerful Reporting Tool

Our processing partners understand how vital transaction reporting is to your business. They offer Real-Time Web Reporting System to review transactions virtually instantaneously. This versatile Internet-based platform offers a vast array of reporting options designed to satisfy your company’s reporting requirements. With this product you can:

• Perform research queries and generate reports on all supported transaction types

• Review transaction history

• Generate a statement according to whatever timeframe you choose.

Gift Card Program

Easy, Affordable and Complete

Our Gift Card program is a great way to increase your sales and create marketing opportunities for your business. You can jump into standard pre-designed gift card program or you can design your own gift cards with Custom Gift Card Program.

Just choose a program and fill out an application. Some of our partners provide gift card processing at no cost. Contact us for more details.

EMV and Security Solutions

Chip cards, also known as “smart cards,” are credit or debit cards that have sensitive cardholder information embedded in a data chip in the card, as opposed to traditional credit cards where the data is only stored in the magstripe on the back of the card. While the two types of cards may look the same, the way that the data is accessed to process a payment transaction is very different. Traditional credit cards are swiped through a magstripe reader, or credit card terminal in order to perform a transaction. Chip cards can be swiped too, but have extra security advantages when processed via EMV chip readers instead.

EMV chip cards help prevent in-store fraud and are nearly impossible to counterfeit. EMV technology increases cardholder security and chip card technology is becoming the global standard for both credit and debit card payments.

The Liability Shift

To increase the adoption of chip technology, Visa, MasterCard, Discover and American Express will implement a liability shift for domestic and cross-border counterfeit transactions effective October 1, 2015.

Once the shift goes into effect, merchants who have not made the investment in chip-enabled acceptance technology may be held financially liable for in-store fraud that could have been prevented with the use of a chip-enabled acceptance device. Vantiv Integrated Payments makes it simple for you to meet the new EMV standards using your POS system.

Next Steps

If you want to avoid the fraud liability after October 2015, you’ll most likely need to implement an EMV capable card reader that can interface properly with your POS system and its software. If your POS system is incompatible with EMV technology, you may need to upgrade your software and hardware. Please contact us to discuss the next steps to take.